- Swing Trading Options

- Account Growth

- Sustainability

- Performance

- Technical Anlaysis

- Market Insight

- Weeklys Exp Date

Performance Results

SKO_Gold_Trades.xlsx

Navigating and Managing a Swing Trading Options Position

Placing a swing options trade and navigating how to enter and exit a trade is a skill needing to be learned by using the tools given by the broker.

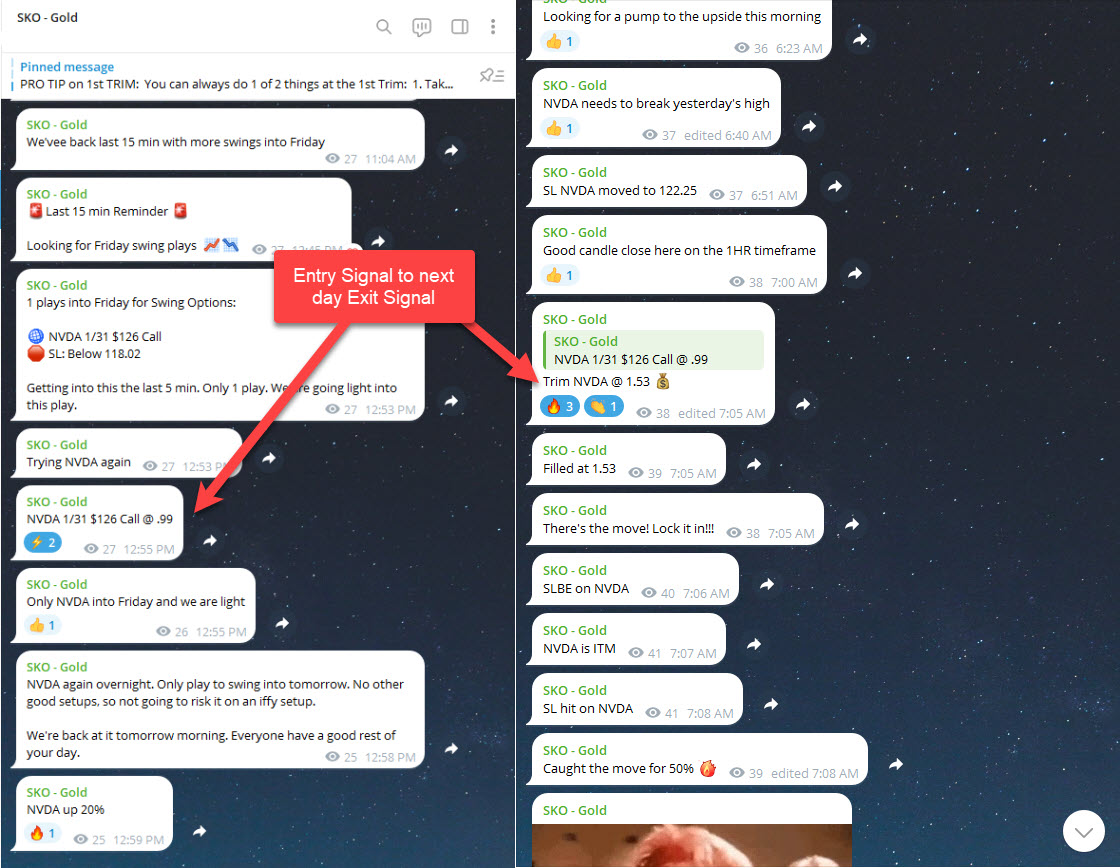

Taking our signals and how to execute the swing plays is a skill within itself. See an example below on an NVDA call options example which we’ll be discussing in detail below:

For us, we use and HIGHLY recommend Charles Schwab Thinkorswim (Formerly known as TD Ameritrade Thinkorswim) which we refer to as TOS.

Why is TOS highly recommended? Simple. Quick fills, but it does come at a cost of $0.65 per contract.

Webull is another broker that does a great job of fills, not like TOS, but Webull is our 2nd best recommendation.

What about Robinhood? Ehhhh. The fills are slow and not great at times. As you become more seasoned swing trading options, you’ll start to understand why quick fills and timing are huge part of managing your position(s).

Using our Gold Trading Room signals for swing trading, Robinhood works, but prices will vary as we use TOS pricing and you might not get the best fills.

You’ve been warned.

Familiarize Yourself with Your Broker's Trading Platform

This is regardless of whether your swing trading options or day trading options.

We’re going to cover 2 popular broker’s:

At first glance, the TOS platform is intimidating, but no worries. We are going to cover how to place a swing options trade using one of our swing trading options signals in our Gold Trading Room.

Once you’ve signed up and have been granted access by our Telegram support team to our Gold Trading Room, you’ll start to receive the stock options signals.

Additionally, we’ll show you examples of Robinhood as well and how they correlate with TOS.

We’ll be using a specific example which we called out in our Gold Trading Room: NVDA 1/31/2025 $126 Call Option

Screenshot below:

Robinhood Placing a Swing Options Trade Example: Step by Step

We’ll be using the Robinhood Desktop App, which is the same as the phone app.

Step 1: Bring up the stock for the stock options being traded

- Mark 1: Go to the Search Bar and Type in: NVDA

- Mark 2: On the right hand side, click “Trade NVDA Options”.

Step 2: Access to the options chain.

- Mark 1: You will always click “BUY”

- Mark 2: Then Call or Put, in this example it’s a CALL

- Mark 3: Strike Price of $126

- Mark 4: Entry, also referred to as Premium or cost per contact

At this moment in time when this article is being published, the price of the NVDA Call options is .14

When these stock options positions are signaled withing the Gold trading room, they were worth $0.99 as they are always signaled in real-time.

Step 3: Start to place the trade

- Mark 1: Set the # of Contacts

- Mark 2: Set the Limit Price ie. Entry Price given in the trading room

- Mark 3: Time in force: Good for Day

- Mark 4: Click “Review Order”

- Place Order

One your order is placed; you can click on it to see if it is FILLED.

Once filled, it will pop up on your positions on your home screen.

Now let’s do the same with TOS.

Thinkorswim Placing a Swing Options Trade Example: Step by Step

Using the same NVDA call option as an example on TOS, we will go through step by step for those who want to make the switch over to a better broker.

Assuming you’re using TOS, we will consider you an experienced trader.

If you are new to trading and just getting started with TOS, YouTube is a good source on how to move on the TOS platform.

Check out the steps below:

Step By Step

- Mark 1: Click “Trade”

- Mark 2: Click “All Products”

- Mark 3: Seach for stock

- Mark 4: Click the appropriate Expiration Date

- Mark 5: Go to the appropriate Strike Price

- Mark 6: Click premium price to setup order

- Mark 7: Verify the contract being bought

- Mark 8: Set the Limit Price

- Mark 9: Click “Confirm and Send”

Once Confirm and Send is submitted, the order will go to the Working tab under Monitor.

Remember, ALWAYS use risk management to size into the trade ie. how many contracts you’re going to use. This is probably the most important aspect of trading.

Then the order will get filled at the amount of contract and price set.

Now the order is active, and you will wait for the exit signal to come out.

As we are swing trading options, we would hold these overnight and manage them the next morning.

Closing the Swing Trading Options Signal

Referring back to our example of NVDA 1/31/2025 $126 Call Option

- Stock: NVDA

- Expiration Date: 1/31/2025

- Strike Price: $126

- Call or Put Strategy: CALL

- Entry Price (Premium): $0.99

Once you have received the signal and placed the trade, now we you for the exit signal to come out the next morning as we hold overnight.

This allows us to avoid the PDT rule. (Pattern Day Trader)

In our Gold Trading Room, we then signal out the exit, see the example below:

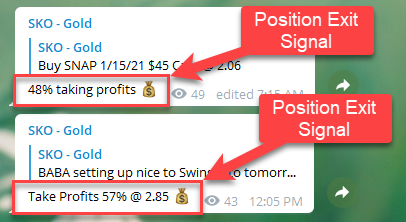

These exit signals are signals out as a Trim or Take Profit.

Trim refers to closing some of the position, this is if you have bought more that 1 contract. If you only bought 1 contract, that be your exit.

If you bought multiple contracts, let’s say 4 contracts, you can trim half the position which is 2 contracts and let the other 2 contracts run.

Again, this all depends on how many contracts you buy. Some can buy 20, and other buy 2. It all depends on your risk management based on your portfolio.

Can You Swing Trade With Options?

We keep our swing trading with options style simple and stick to the basics of just buying calls and puts at Stock King Options.

This is one where essentially it enables the taking of medium-term advantages of overnight fluctuations of stock movement on whether the market goes up or down, that’s it.

Can you swing trade with options? Yes, swing trading with options is possible and can be highly effective.

Traders use options to capitalize on short- to medium-term price movements, leveraging strategies like buying calls or puts, covered calls, and credit spreads to manage risk and maximize profit potential.

We keep it simple so the beginner to intermediate level type traders can join our Gold Trading Room and take advantage of our real time entry and exit swing options trading signals.

Risk Managment: What Is The 1% Rule In Swing Trading?

The 1% rule in swing trading is a fundamental guideline emphasizing risk management; it essentially advocates that traders should not risk more than 1% of their trading capital on any single trade.

This principle becomes even more relevant when moving to swing trading options, since price movements can be volatile, and timing is everything.

What is the 1% rule in swing trading? The 1% rule in swing trading limits risk by ensuring no more than 1% of a trader’s total account balance is risked on a single trade.

Featured

Stock Option Service

Gold Trading Room Access.

Trading strategy: Swing Trading

# of Signals: 1-2 Signals/Daily

Perfect for the beginner/Intermediate trader looking to take advantage of overnight swings trading stock options.

Our Gold Trading Room Features

Swing trading options is a popular strategy among the more seasoned traders. This usually means we’re buying into a stock options position and hold overnight. One thing in common with any swing trades is that we are in a trade for at least 1 day and hold overnight as mentioned in our Stock King Options trading rooms.

- Entry alert positions are typically called out on the last 15 min of the day, we hold overnight, and we then monitor the trade the morning. Simple!

Gold Trading Room Examples

When in profits, we'll call out our first price Trim for our initial take profit.

Once we start seeing returns, we scale or trim our position, which means take profits for most of our contracts. For those who only open 1 contract, we highly recommend we take profits on the first Trim called out.

Our Trading Strategy

These stock options entry alert positions are typically called out on the last 15 min of the day, we hold overnight, and we then monitor the trade the morning.

Strategy: swing options position entry signal right before end of day and sell the next morning.

Everyday, we send the following:

- 15 min reminder

- Swing Positions Watchlist

- Our Entry Fills

- Entry Last 5 min

The main goal is to exit the trade with anything above a 20%+ gain for any signal called out in our stock options trading channel: SKO – Gold.

Taking Profit: Take the first trim signal or set your stop loss at breakeven and let the play run! 2 different types of management styles based on how aggressive you want to be

As the essence of the trading room is to swing trade stock options, holding them overnight is the ideal strategy. This we we can also avoid the PDT rule (Pattern Day Trader).

Stop Loss

For our stop loss, we watch specific level for the symbol which was called out. We are constantly watching the charts to signal out a close.

If a specific level is reached, the exit signal is called out. At this point is where we completely exit the trade.

Pro-Tip: Executing the Stop Loss strategy is a bit more difficult with Robinhood as you would need to use the Stop-Limit feature.

Our recommendation to traders is to use Webull or TD Ameritrade where the Stop Loss feature is more direct.

Overview

Our Gold swing trading options room is made for overnight hold periods. This strategy allows us to take advantage of gap ups and gap down in the markets. This allows to make decisions on the position at bell open.

It’s a slower approach as far as the velocity of options trades. Typically we signal 1-2 stock option positions around 10 min before bell close.

If you fall under one of the criteria below, this is what we would consider a perfect candidate to start in our Gold Trading Room:

-Beginner or Novice to options trading

-Less trade monitoring

-Broker account over 1K+ to start

-Avoid the PDT (Pattern Day Trader) rule.

You don’t have to fulfill all of the above. It’s a good place to start if you’re new to trading stock options.

If this sounds like it’s a good fit to start swing trading stock options options, once you sign up we will get you set up in about 5 min.

Our alerts come from the Telegram app. If you have any questions, please reach out to us. You can contact us through one of the following:

-Telegram: @stockkingoptions (fastest!)

-Text Us: (305) 697-5405

-Instagram: @stockkingoptions

-Email Us: support@stockkingoptions.com

If you’re looking for something with faster returns on a daily basis, we have 2 additional options day trading room available as well. Check out some of our other rooms below.

Onboarding

If the Gold Trading Rooms seem like a good fit. Use the following link below to sign up. Once you sign up, we can get you set up within 5 min.

Just reach out to us on Telegram: @stockkingoptions (fastest option!) with your sign up email we’ll get you set up. Looking forward to hearing from you!

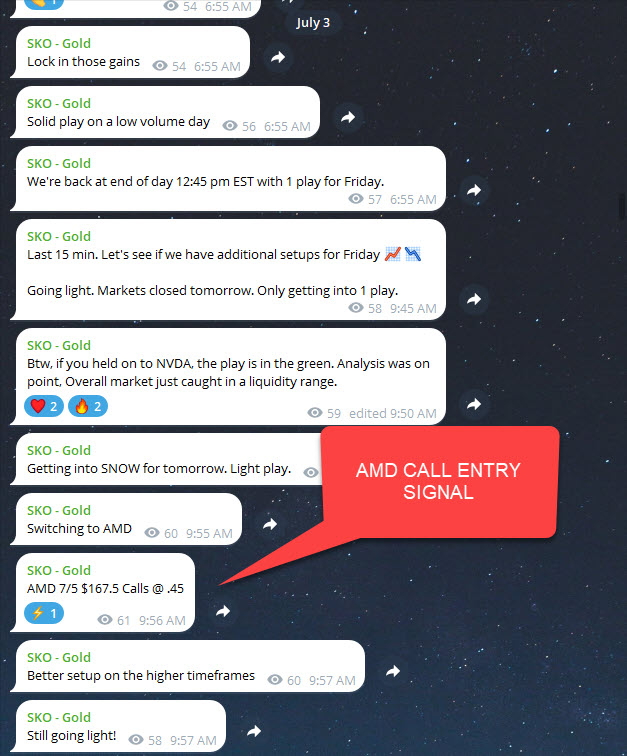

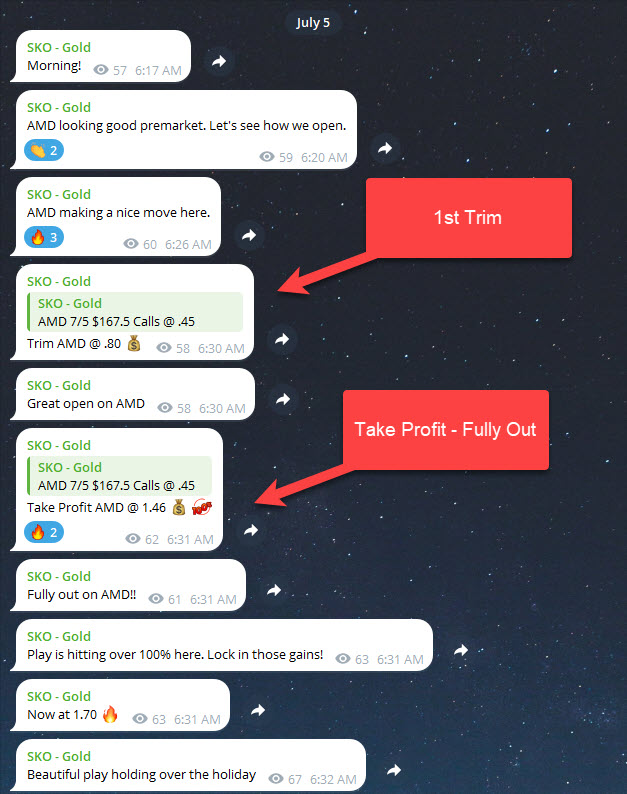

SWING TRADING OPTIONS EXAMPLE 1 - AMD CALL

AMD calls on 7/3/2024 was a great play called out in our Gold trading room. As you can see on the daily timeframe, we got into this play after a day of strength on the previous day. On the day it was signaled, we had some movement to both sides but we were left in day of indecision.

Previous price action told us we had broken to the upside. We formed a bull flag where we started to break liquidity levels. This signaled to us an entry play for the next day. As you can see below, we called out AMD calls, 7/5/2024 expiration date, $167.5 strike, and an entry of .45.

Our swing trading options strategy is always to call the plays 5 min before bell close. Please note this play it was called out at 9:56 am, when the market closed at 10 am due to the July 4th holiday.

This AMD entry was .45 which means for each contract that we purchase, it cost us $45 dollars. If you bought 10 contacts, this would cost a total of $450 dollars.

As we swing trade options in our Gold trading room, we’ve analyzed the play to gap up the next morning.

At bell open, AMD gaped up in the morning, pulled back a bit and proceeded to rip to the upside the rest of the day. If only they all could be like this.

See the price action below on July 5th as we did not trade on July 4th for the holiday.

Our first trim on this AMD swing trading options play was at .80. Once we got our first trim, we held the rest of the position and exited at 1.46 as out premium.

See the exit signals noted as the Trim and Take Profit.

This is a prime swing trading options example, as we had no drawdown on the play with a nice clean gap up with follow through.

At Trim, the swing play was 77%. At Take Profit, this play was closed out at 224%.

Got to love the power of stock options.

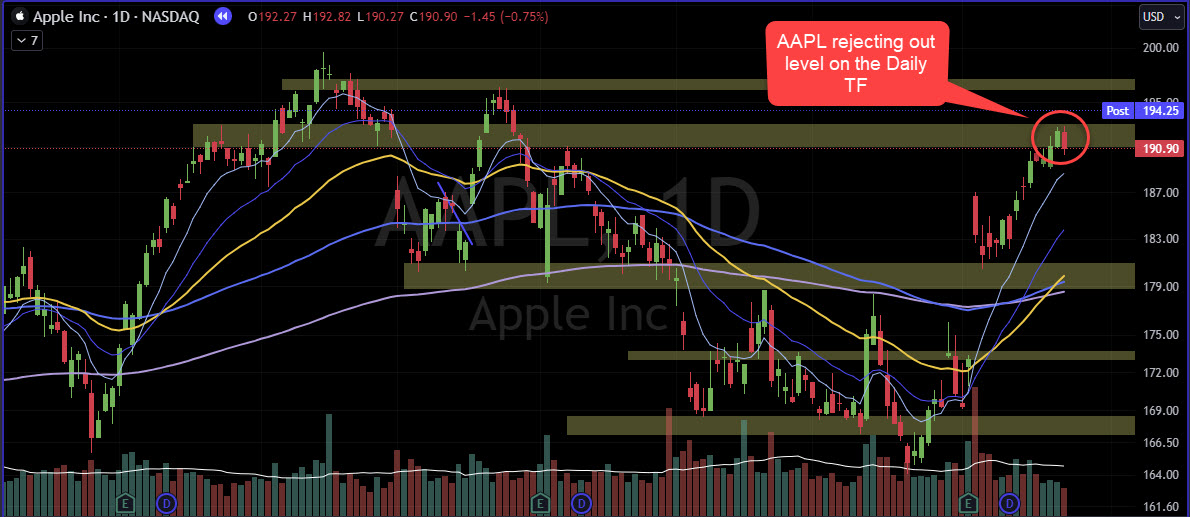

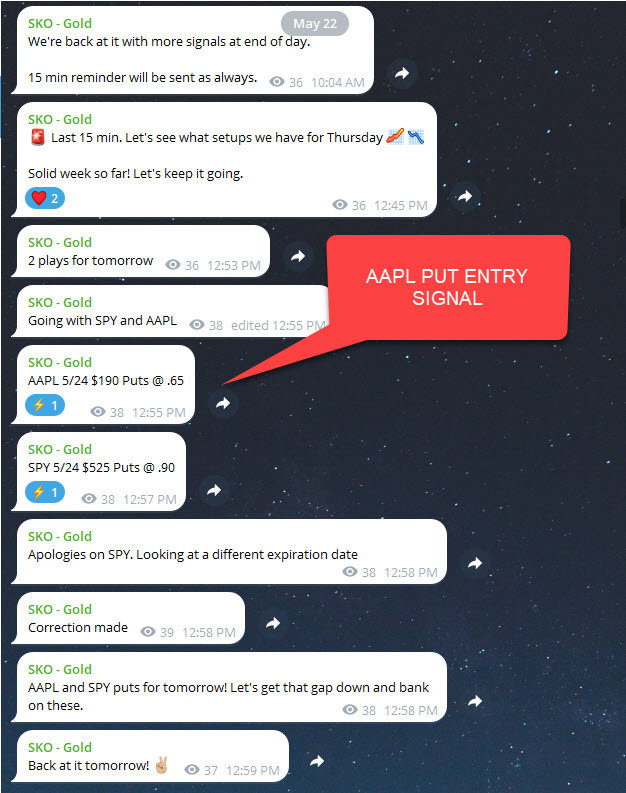

SWING TRADING OPTIONS EXAMPLE 2 - AAPL PUT

In this swing trading options example, we called out this AAPL Put play on 5/22/2024. We saw the rejection off of our level with a bearish engulfing candle at that same level.

This showed that the market was showing weakness at the level, therefore we called out a Put play on AAPL in our Gold trading room. See the example of the entry signal below.

Our options swing trading position was AAPL Put; 5/24/2024 Expiration Date; $190 for the strike price. We always have a reminder signals 15 min before market close to make sure our members are ready to act on the entry signal which is called out 5 min prior to market close.

In with AAPL swing options trading signal our premium entry signal was $0.65. This means that our position at the time that we bought it cost us $65 per contract.

Since we’re swing trading options and getting into them right before close, we’re looking for the AAPL market to gap down on us and we take advantage of the overnight move.

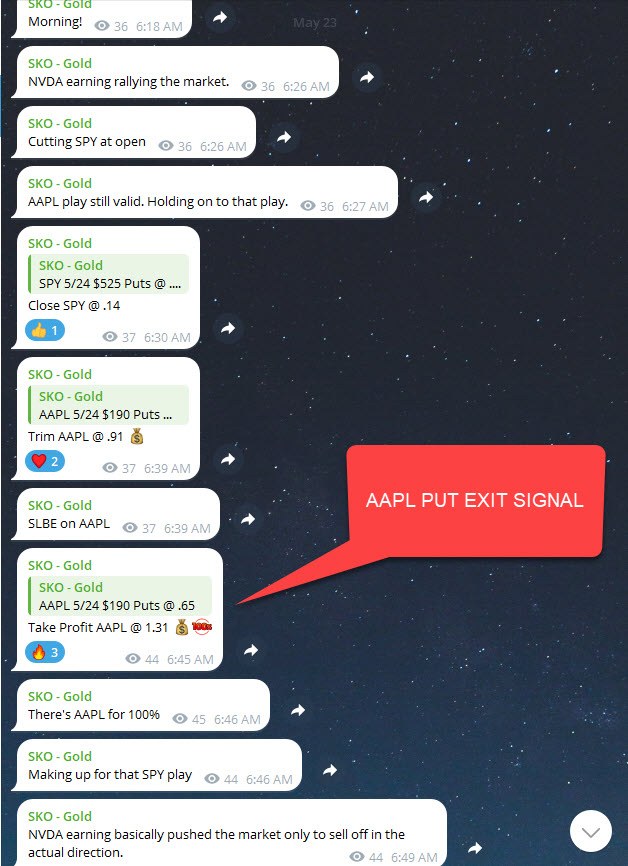

The next day at bell open, we AAPL opened a bit above our entry, so we did have some draw down. We were confident in our position as it was holding out level.

Eventually the market made the move to the downside. as we predicted. See the screenshot below.

We initally trimmed some of our position at $0.91 premium per contract on our options swing trading which was about 40%. Eventually, we closed out the rest of the position at $1.31, which was 100% gain on the position from entry. Exit stock options signals are below:

On the next day, the AAPL market had a huge move to the downside, so these contracts were worth well over 400% on gains by end of day. We did have some members who held through the entire move and had a big cash out day.

This is a perfect example of the type of swing trading options signals we call out in our Gold trading room. Not only how simple it is to understand the swing options signals, but the timing of everything which is was we do on a daily basis.

This is perfect fit for people who do not want to spend all day looking at the charts or can’t spend a lot of time looking at the charts as they have a 9 to 5 which requires most of their attention.

Only minimal time is required on screentime or you can only act on the signals which are given. Also, it’s a perfect for the beginner swing options trader as it’s a slow paced trading room and simple to understand stock options.

If you’d like to start swing trading with options in our Gold trading room, use the following link to sign up: stockkingoptions.com/gold-membership.

Understanding Swing Trading Options

Swing trading options is a way how beginners get into trading stock options as it is a straight forward type trading that is slower paced. However, it requires at minimum a basic understanding of the underlying principles and strategies.

In this section, we will look into some of the following aspects; understanding strategies, risk management, and avoiding the PDT rule.

As swing trading options is slower placed, we can take the time to fully understand what’s happening in the markets without huge moves occuring.

Understanding Swing Trading Options Strategies

In trading, knowing different strategies is super important for success, especially when swing trading options.

When you’re swing trading options within the stock market, having a good strategy can help you lower risks as you look for high quality setups.

One popular strategy is called, the break and retest strategy. It’s all about spotting levels on the higher time frames, such as the 1H, 4H, and the Daily timeframes.

People who use this strategy look at technical analysis such as like moving averages, support and resistance levels, and candlestick price action patterns to know when to buy or sell.

Managing risk is really important when implementing a swing trading options strategy. It means figuring out levels and having a stop loss set in case a trade goes against your trading plan.

The PDT rule was made to protect small investors who might get carried away with frequent day trading.

If you make four or more day trades in five days, you’re called a Pattern Day Trader and need at least $25,000 in your account. This is when swing trading options comes into play to avoid the PDT rule.

To avoid being a Pattern Day Trader, you can try swing trade options instead of day trading options. Swing trading options means holding onto positions at minumum overnight, or you can also hold over a couple of days as well.

Either way, holding overnight is now considered a swing trade which is a work around avoiding the PDT rule.

Understanding different strategies and managing risks is super important for doing well in the stock market, especially when trading stock options and their very volatile.

Slower Paced Style of Swing Trading Options

Trading stock options in a slow and steady pace fits right in with swing trading options. This method is good for beginners or people who don’t want to take big risks.

Instead of making lots of trades quickly, you hold onto your positions for at minimum overnight to a few days. This can help you grow your money steadily and avoid big losses.

The key here is to be patient. Instead of rushing into trades, take your time to pick the right stock options with the desired expiration date. Just know that the further out the expiration date, the more the premium for the stock option position.

One good thing about this method is that it works well with the PDT rule.

This rule says you can only make three day trades in five days if you have less than $25,000 in your account. By swing trading and holding positions overnight, you can avoid this rule altogether.

Another advantage of swing trading since you’re looking at higher time frames by design, you catch a majority of the bigger move resulting in larger profits.

But remember, even though this method is “safer”, there’s still some risk involved. You could still lose money if a trade does not go your way.

The key is to follow your swing trading options plan.

To do this method right, you need to understand how to analyze stocks and price action and use techincal and fundamental analysis to find good opportunities.

Swing trading options is a slower-paced style of trading stock options which is made for the beginner trading.

By being patient, using analysis tools, and managing risks, you can do well implementing a swing trading options style of trading to avoiding the PDT rule.

Avoiding The PDT Rule by Swing Trading Options

The Pattern Day Trader (PDT) rule is a rule that stops people from making too many day trades if they don’t have enough money or experience.

It says that if you make four or more day trades in five days, you need to have at least $25,000 in your account.

This rule is there to protect new traders from losing too much money too quickly.

But it can be a problem for people who are just starting out or don’t have enough money to follow the rule.

Luckily, there are ways to avoid being labeled as a pattern day trader while still trading in the stock market by swing trading stock options.

Swing traders hold onto their positions overnight, so they don’t count as day trades. Allows us to avoid the PDT rule.

Another way is to use multiple brokerage accounts. If you spread your trades across different accounts, you won’t trigger the PDT rule on any single one.

But remember, this might cost you more in fees and also a bit more confusing managing your positions.

Brokers offer cash accounts that don’t fall under the PDT rule. These accounts don’t let you borrow money to trade, but they also don’t require you to have $25,000 in your account.

This is the typical go to for new traders, but one thing you should know is that funds will be on hold as they settle, so they cannot be used until they do settle.

Different brokers offer difference fund settling days. TD Ameritrade settles the funds overnight which is ideal, but they do have $0.65 per options contracts in fees.

While the PDT rule might seem like a hassle, there are ways to work around it. Knowing about these tactics can help you trade avoid the PDT rule.ioio

- Brokers offer cash accounts that don't fall under the PDT rule. These accounts don't let you borrow money to trade, but they also don't require you to have $25,000 in your account.