Add Your Heading Text Here

- Day Trading

- Account Growth

- Consistency

- Performance

- Technical Analysis

- Market Insight

- 0DTE / 1DTE Exp Trades

Performance Results

SKO_Platinum_Trades.xlsx

Platinum

Tickers Traded

Day Trading Options - Platinum Trading Room Features

Day trading options is a popular strategy among the more seasoned traders. This means we’re in a trade from minutes to a couple of hours. One thing in common with any day trades is that we are in and out of the trade within the same day. We have 2 trading rooms dedicated to this style of trading in our Stock King Options Trading Rooms.

You have to stay disciplined with day trading options as we try to to take advantage of the quick movements with bigger positions.

Typically, the first hour of the stock market opening is the best time to take advantage of day trading options due to the volatility.

This is where our Platinum Trading Room shines. We give an average of 2+ trades a day where we focus on mostly 0DTE stock options positions when day trading specific securities: SPY, QQQ, and IWM.

Usually, our positions are taken within the first hour but we do monitor the market all day. Any time we reach 20%+, we usually take profit which we’ll talk about in the Managing the Position segment below.

The expiration date is usually 0DTE (0 Days Till Expirations), so we can keep the consistency. The closer it is to the end of the day the smaller the sizing of the trade. Therefore, trades taken at the end of the day are smaller in size.

The goal of day trading is to catch small market moves where we’re taking advantage of the momentum of a stock or turning point of the markets. We aim to calling out high quality setups.

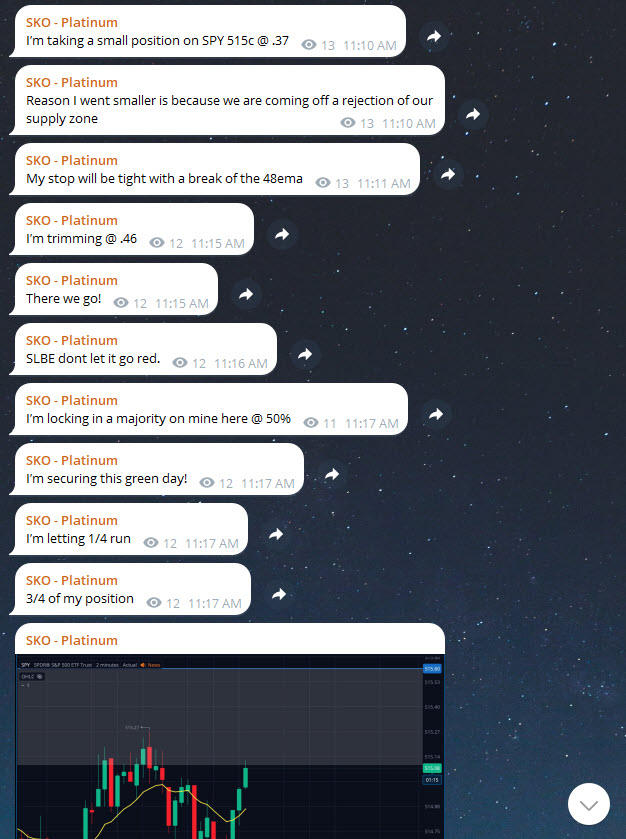

Below are examples of how we call our stock option signals in our Platinum Trading Room.

- This allows you as the trader to follow our position second by second. As we profit, you do as well.

Platinum Trading Room Example

Setup / Entry / Exit Signals

In this SPY example, we call out what stock option position we are watching We give the Strike Price, Call/Puts, and expiration date. Additionally, we give the confidence in the setup. Once the market starts to move, we start calling out the trim prices in real-time. This allows you as the trader to follow our position second by second. As we profit, you do as well.

Managing the Position

Remember the goal of day trading, it’s to take advantage of the quick movement within the markets on a daily basis. Usually, a typical goal for day trading is to take profits for any gains above 20%.

Closing our trades or Trimming goes as follows:

1st Trim >>> 20% Profits

2nd Trim >>> 50% Profits

3rd+ Trims >>> 50-100%+

Once the first Trim is called out, we close a majority of our position and leave runners open. We set our Stop Loss to breakeven allow the rest of the trade so the trade can be risk free.

If you are a conservative trader or a trader who is not trading with huge capital, we recommend to close 75% of 100% of the position.

If you are an aggresive trader, you would only set the Stop Loss and wait for the 2nd Trim to close out on bigger sizing.

The choice is yours. Find what works best for you, your style, and emotions.

These profits can be gained in a matter of seconds to a couple minutes at times with day trading depending on the markets.

Taking advantage of the first hour volatility is the strategy which we take in our Platinum trading room. Our trades are usually opened throughout the day then managed once they’re open. Typically, we do not have multiple trades opened at once.

We signal out 2+ trades on a daily basis hour in our SKO – Platinum day trading option room. We try to keep it as consistent as possible with high quality trades using our 2 minute strategy.

Stop Loss

For our stop loss in our Platinum Trading Room, we usually use the 13 EMA as a stop loss which is typically around a 20-25% loss when a trade goes compltely against us.

Stop losses are placed so we do not lose all of our capital. If you’re trading without a stop loss, it’s like driving a car without brakes.

If a risky trade is called out, we usually signal it as such in our confidence section of the setup signal. Day trading options rely a lot on risk management. Please trade accordingly.

As seasoned traders, we stick to our 2 minute trading plan. These rules are there so you don’t jeopardize your entire portfolio, and we cannot stress risk management enough.

Overview

Our Platinum day trading options trading room is made for quicker holding periods, vigilant monitoring of trades, and high velocity of options trades. Below is what we would consider a good candidate to start in our Platinum Trading Room:

Intermediate or Expert in options trading.

Active trade monitoring throughout the day.

Broker account over 2K+ to start.

You don’t have to fulfill all of the following. If this sounds like it’s a good fit and a good speed for you to day trade options, we can get you set up in about 5 min.

Our alerts come from the Telegram app. If you have any questions, please reach out to us. You can contact us through one of the following:

-Telegram: @stockkingoptions (fastest!)

-Text Us: (305) 697-5405

-Instagram: @stockkingoptions

-Email Us: support@stockkingoptions.com

If you’re looking for slower trading or a trading room that encompasses both day and swing trading on a daily basis, we have 2 additional options day trading room available as well. Check out some of our other rooms below.

Onboarding

If the Platinum trading room seems like a good fit. Use the following link below to sign up. Once you sign up, we can get you set up within 5 min.

Just reach out to us on Telegram: @stockkingoptions (preferred) with your sign up email and we’ll get you set up. Looking forward to hearing from you!

Featured

Stock Option Service

Platinum Trading Room Access.

Trading strategy: Day Trading

# of Signals: 2+ Signals/Daily

Perfect for the Intermediate/Expert trader looking to take advantage of 0DTE/1DTE expiration stock option positions

Grasping Day Trading Options

Day trading options can be a lucrative and exciting venture for those looking to make quick profits in the financial market. However, it requires a deep understanding of the underlying principles and strategies involved in order to succeed. In this section, we will delve into the various aspects of day trading options and provide valuable insights on how to grasp this complex but potentially profitable form of trading.

Understanding Options:

Firstly, it is essential to understand what options are and how they work before venturing into day trading them. In simple terms, an option is a contract between two parties that gives the buyer (also known as the holder) the right but not the obligation to buy or sell an underlying asset at a predetermined price and within a specified time frame. The underlying asset could be stocks, commodities, currencies or any other financial instrument.

Types of Options:

There are two types of options – call options and put options. A call option gives the holder the right to buy an asset at a specified price within a specific time period while a put option gives them the right to sell an asset at a predetermined price within a set timeframe.

Strategies for Day Trading Options:

One of the key considerations when day trading options is choosing which strategy to use. Some popular strategies include buying calls or puts, selling covered calls or cash-secured puts, straddles, strangles and iron condors. Each strategy has its own risk profile and potential for profit depending on market conditions.

Risk Management:

It’s crucial for day traders to have robust risk management practices in place when dealing with any type of investment instrument, and this holds true for day trading options as well. Due to their leverage nature, options can result in significant losses if not managed properly. Traders should always have stop-loss orders in place along with strict position sizing rules.

Volatility Considerations:

Another vital aspect for traders to grasp when dealing with day trading options is volatility. In simple terms, volatility refers to the degree of price fluctuation in an underlying asset. Options on highly volatile stocks or indices are more expensive due to the increased potential for significant price movements, while options on less volatile assets will be relatively cheaper.

Grasping day trading options requires a comprehensive understanding of the underlying principles, strategies and risk management techniques involved. With proper knowledge and disciplined execution, it can be a profitable endeavor for those looking to make quick gains in the financial market.

- In simple terms, volatility refers to the degree of price fluctuation in an underlying asset.

Terminology for Stock Options

Terminology for stock options can often be confusing, especially for beginners in the world of day trading options. However, understanding these terms is crucial for success in this market. In this section, we will break down some of the key terminology used when discussing stock options.

1. Call Option: A call option is a contract that gives the holder the right to buy a specific stock at a predetermined price within a certain time frame. This allows traders to profit from an increase in the stock’s price without actually owning it.

2. Put Option: On the other hand, a put option is a contract that gives the holder the right to sell a specific stock at a predetermined price within a certain time frame. This allows traders to profit from a decrease in the stock’s price without actually owning it.

3. Strike Price: The strike price refers to the predetermined price at which an underlying asset (in this case, stocks) can be bought or sold through an option contract.

4. Expiration Date: Every option contract has an expiration date, after which it becomes invalid and cannot be exercised anymore.

5. In-the-Money (ITM): An option is considered ITM when its strike price is favorable compared to the current market value of its underlying asset. For call options, this means that the strike price is lower than the current market value, while for put options, it means that the strike price is higher than the current market value.

6. Out-of-the-Money (OTM): Conversely, an option is considered OTM when its strike price is not favorable compared to its current market value – meaning it would not be profitable if exercised at that time.

7. At-the-Money (ATM): An option with a strike price equal to its underlying asset’s current market value is said to be ATM.

8. Intrinsic Value: The intrinsic value of an option refers to how much profit could theoretically be made if the option were to be exercised immediately. It is calculated by taking the difference between the current market value of the underlying asset and the option’s strike price.

9. Time Value: The time value of an option refers to the additional cost above its intrinsic value, which is influenced by factors such as volatility and time until expiration.

10. Delta: Delta measures how much an option’s price will change based on a $1 movement in its underlying asset’s price. A delta of 0.5, for example, means that for every $1 increase in the stock’s price, the call option’s price will increase by 50 cents.

Understanding these terms will help you navigate through trading options with more confidence and make informed decisions about your investments. Keep in mind that this is just a small portion of the terminology used in options trading, but it provides an excellent foundation for beginners looking to enter this market. In the next section, we will discuss some strategies that can be used when day trading options.

Comparing Call Options and Put Options

When it comes to day trading options, there are two main types of contracts that traders can utilize: call options and put options. These two options have distinct characteristics and can be used in different ways to achieve varying trading strategies. In this section, we will compare and contrast the key features of call options and put options.

Call Options:

A call option gives the buyer the right, but not the obligation, to buy an underlying asset at a predetermined price (known as the strike price) within a specific time frame. This means that if you buy a call option on a particular stock, you have the right to purchase that stock at the strike price before the expiration date.

One major advantage of call options is their potential for unlimited gains. If the underlying stock’s price increases significantly before expiration, the buyer can exercise their option and profit from buying at a lower strike price. Additionally, call options offer leverage because they allow traders to control a larger amount of shares with less capital.

However, this potential for unlimited gains comes with higher risk. As mentioned earlier, buyers are not obligated to exercise their call option and may lose all of their investment if the stock’s price does not reach or exceed the strike price before expiration. Moreover, since these contracts have an expiration date, timing is crucial when trading call options.

Put Options:

On the other hand, put options give buyers the right to sell an underlying asset at a predetermined price within a specific time frame. Similar to call options, if you own a put option on a stock and its value decreases significantly before expiration; you can exercise your contract and sell it at a higher predetermined strike price.

The primary benefit of put options is that they serve as insurance against potential losses in your portfolio. For example, if you own 100 shares of XYZ Company and its stock prices start declining; purchasing one put option will limit your total loss compared to holding just stocks alone.

However, the downside of put options is that they have limited profit potential. The most a buyer can gain from exercising a put option is the difference between the strike price and the current market price. Additionally, timing is also crucial when trading put options.

Call options and put options are valuable tools for day traders as they offer unique benefits and risks. It is essential to understand their differences and how they can fit into a trader’s strategy before using them in real-time trades.

3 Types of Day Trading Options Strategies

Day trading options can be an exciting and lucrative way to trade in the stock market. As a beginner, it’s important to understand the various strategies that can be employed to make the most out of your trades. In this section, we will discuss three types of day trading options strategies: scalping, swing trading, and trend following.

1. Scalping:

Scalping is a high-frequency trading strategy where traders aim to profit from small price movements within a short period of time. This type of strategy requires quick decision-making skills and precise execution as positions are typically held for just a few minutes or even seconds.

The key principle behind scalping is to take advantage of market inefficiencies and capitalize on small price fluctuations multiple times throughout the day. Traders using this strategy tend to use technical analysis tools such as charts and indicators to identify entry and exit points for their trades.

While scalping can yield fast profits, it also carries higher risks due to its short-term nature. Traders must be vigilant in monitoring their positions as any sudden market movements could result in significant losses.

2. Support and Resistance Trading:

Finding support and resistance is crusual to day trading stock options. The goal of is capturing quick price movements off of the support and resistance levels. This type of strategy involves identifying levels in the market and taking advantage of them by entering and exiting positions at strategic points based on price action.

Day traders often use both technical and EMA analysis when making their trades. They look for stocks with strong potential for bounces of intraday levels. Candlestick analysis tools is then used to determine entry and exit points.

Compared to swing trading, day trading has higher risk as trades are held for shorter period allowing a trick trim in profits when the stock moves to volatility. However, there is high level of risk involved as unexpected events can impact stock volatilty and move the market quickly in a certain direction during a news period.

3. Trend Following:

Trend following is a can be used as a short-term strategy where traders follow the market trend rather than trying to predict it. This strategy involves taking positions in the direction of the overall trend and staying in the trade until there is a significant change in direction.

Traders using this strategy rely heavily on technical indicators such as moving averages, MACD, and Bollinger Bands to identify trends and determine entry and exit points. This type of strategy requires patience and discipline as trades can be held for weeks or even months.

One of the advantages of trend following is its potential for big profits. However, it also carries higher risks as traders may need to hold positions through market fluctuations before seeing significant gains.

Understanding these three types of day trading options strategies will give beginners a good foundation for their trading journey. It’s important to carefully consider each strategy’s pros and cons before deciding which one suits your risk tolerance and trading style best.