So you want to start day trading options? If you’re ready to dive into a fast-paced and potentially lucrative form of trading, then you’ve come to the right place. Whether you’re a seasoned trader looking for new opportunities or a beginner just starting out, Stock King Options want’s to provide provide you with the basics and strategies needed to navigate the exciting realm of options day trading.

Stock options give traders the ability to profit from market movements without actually owning the underlying asset. This flexibility can provide unique opportunities for those who know how to leverage them effectively.

However, before we delve into specific strategies and techniques, let’s start by understanding the fundamentals of day trading options. So buckle up and get ready for an adrenaline-fueled journey through the world of options!

Basics of Day Trading Options

Options are financial derivatives that give traders the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time frame. In day trading options, traders aim to take advantage of short-term price movements in these contracts.

One key aspect of options trading is understanding strike prices. The strike price is the predetermined price at which an option can be exercised. There are two types of options: call options and put options. Call options give traders the right to buy the underlying asset at the strike price, while put options give them the right to sell it.

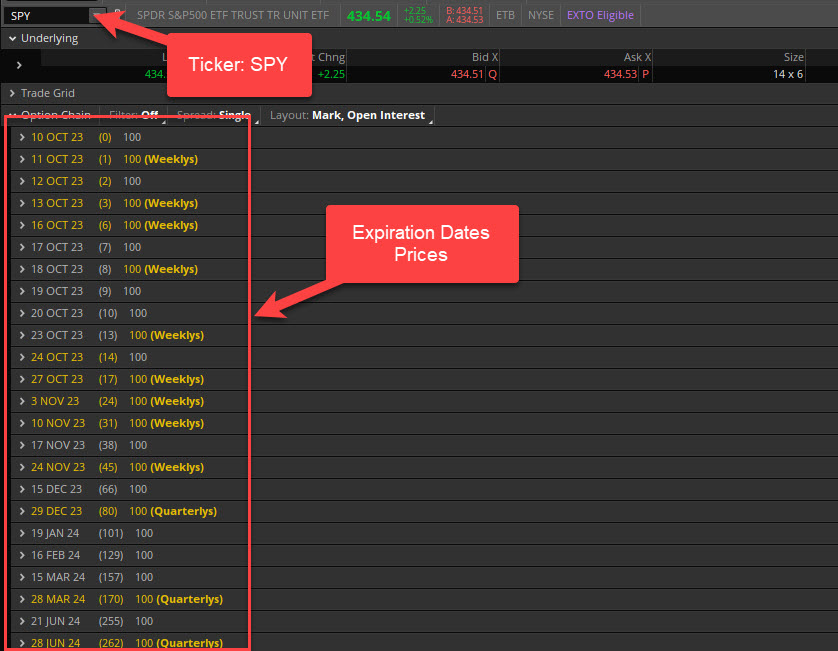

Another important concept is expiration dates. Options have expiration dates that determine how long they remain valid for trading. It’s crucial for day traders to be aware of these dates as they plan their strategies accordingly. We will talk about when to take in-the-money or out-the-money strike prices.

Leverage plays a significant role in day trading options due to their lower upfront costs compared to buying or selling stocks outright. With leverage comes increased risk, so it’s essential for traders to carefully manage their positions and set strict stop-loss orders. It is crucial to follow your trading rules when day trading.

Another aspect is charting. Learning to chart is a skill within itself to find important levels in the markets. We use Tradingview to chart all the price action going on. This will allow you to reference levels and to make insightful decisions on where the market is going to go.

To succeed in day trading options, it’s vital to stay informed about market news and trends that may impact your chosen assets. Having access to real-time data and analysis tools can help you make more informed decisions when executing trades. Additionally, you must always be aware of economic news which can also be a catalyst in volatility.

Remember, mastering the basics is just the first step on your journey into day trading options! As we move forward, we’ll dive deeper into strategies and techniques that will enhance your chances of success in this realm of day trading stock options.

Pros and Cons of Options Day Trading

Options day trading can be an exciting way to participate in the financial markets. It offers unique opportunities for traders to profit from both rising and falling prices, as well as limited risk exposure. However, like any investment strategy, there are pros and cons that should be considered.

One of the major advantages of options day trading is the potential for high returns. With leverage, traders can control a large amount of underlying assets with a relatively small investment. This means that even small price movements can result in significant profits if timed correctly.

Another benefit of options day trading is the flexibility it provides. Traders have the ability to choose from a wide range of strategies depending on their goals and market conditions. They can buy or sell options contracts, hedge existing positions, or speculate on volatility.

However, it’s important to note that options day trading also comes with certain risks. Options contracts have expiration dates which means they have time value decay. If the underlying asset doesn’t move in your favor within a specific timeframe, you may lose all or part of your investment.

Additionally, options day trading requires knowledge and skill to be successful consistently. It’s not something that can be easily mastered overnight – it takes practice and experience to understand how different factors such as Greek values (delta, gamma etc.) affect option prices.

Furthermore, options day trading involves frequent buying and selling which leads to higher transaction costs compared to traditional investing methods.

Therefore, traders should carefully consider these fees when calculating potential profitability

In conclusion, options day trading has its own set of advantages and disadvantages.

It has immense profit potentials but at the same time, it carries risks.

Traders should weigh these factors before deciding whether this strategy aligns with their financial goals.

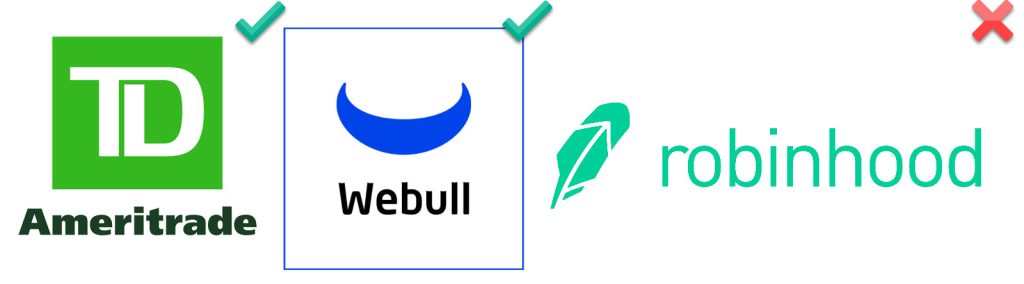

Best Brokers for Day Trading Options

We’ll make this easy from the beginning, TD Ameritrade ThinkorSwim or Webull. That’s it! When it comes to day trading options, having a reliable and efficient broker is essential. With the right broker, you can execute your trades quickly and accurately, maximizing your potential profits. So, what are the best brokers for day trading options?

One top choice for many traders is TD Ameritrade. Known for its robust platform and advanced tools, TD Ameritrade offers a wide range of options trading capabilities. Their Thinkorswim platform provides real-time data and analysis, making it easier to identify opportunities in the market.

The only drawback is they do chart $0.65 per contract. Other than that, you get your quickest order fills with TDA TOS. Also, the Active Trader tool is a great way to manage you stock option trades and you can get in and out of a play in just 1 click. Highly recommended for those serious about trading stock options.

Webull is another one that we highly recommend. $0 is in fees like Robinhood but a better more sophisticated look and feel offering better tools to trade the markets such as better charting options. The options chain is similar to TDA, so if you’re a beginner, that will be learning curve.

Another popular option is Interactive Brokers. With low commission rates and access to over 100 markets worldwide, Interactive Brokers caters to both beginner and experienced traders alike. They also offer a variety of educational resources to help you improve your trading skills.

For those looking for user-friendly platforms with competitive pricing, E*TRADE might be the right fit. Their Power E*TRADE platform offers intuitive navigation and real-time streaming quotes, making it easy to monitor your trades throughout the day.

The best broker for day trading options will depend on your individual needs and preferences. It’s important to consider factors such as commissions, platform features, customer support, and educational resources when choosing a broker that aligns with your goals as a trader.

Understanding the Greeks in Options Day Trading

When it comes to day trading options, understanding the Greeks is crucial. These Greek letters represent different variables that help us evaluate and manage risk in options positions. Let’s take a closer look at some of the key Greeks you need to understand.

Delta

Delta is one of the most important Greeks as it measures how much an option’s price will change in relation to a $1 move in the underlying stock. A delta of 0.5 means that if the stock moves up or down by $1, the option price will increase or decrease by 50 cents.

Theta

Theta represents time decay and measures how much an option’s value decreases with each passing day. As an options day trader, being aware of theta is essential because it affects your profit potential when holding overnight positions.

Vega

Another crucial Greek is Vega, which quantifies an option’s sensitivity to changes in implied volatility. When volatility increases, so does Vega, leading to higher premiums for options contracts.

Gamma

There’s Gamma – this Greek determines how quickly Delta changes as the underlying stock price moves. It essentially measures Delta acceleration and helps traders assess their exposure to changes in stock prices.

By understanding these Greeks and incorporating them into your trading strategy, you can better forecast potential risks and rewards associated with different options trades.

Remember: mastering these concepts takes time and practice! So don’t get discouraged if they seem overwhelming at first – keep learning, experimenting, and refining your approach!

Types of Strategies to Use for Day Trading Stock Options

When it comes to day trading stock options, having a solid strategy is essential. There are various strategies you can employ depending on your risk tolerance and market conditions. Here are a few popular ones:

Long Call or Put

This strategy involves buying either call options or put options with the anticipation that the underlying stock will move in the desired direction. It allows for potential large gains if the stock price moves significantly.

Covered Call

In this strategy, you own shares of the underlying stock and sell call options against those shares. The goal is to generate income from selling these options while still potentially profiting from any upside movement in the stock.

Straddle

A straddle involves simultaneously buying both a call option and a put option at the same strike price and expiration date. This strategy is used when there is an expectation of significant volatility but uncertainty about which direction the stock will move.

Iron Condor

An iron condor is a combination of two credit spreads – one bearish (using puts) and one bullish (using calls). It’s designed to benefit from range-bound markets where there isn’t much movement in either direction.

Remember, every trader has their own preferred strategies based on their risk appetite and experience level. It’s important to thoroughly understand each strategy before implementing them in your trades.

Choosing the right trading strategy requires careful analysis of market conditions, risk management skills, and understanding your own personal preferences as a trader!

How to Execute Stock Options Trades

Executing stock options trades is a crucial step in day trading options. Once you have done your research, analyzed the market, and selected the options contracts you want to trade, it’s time to take action.

ProTip: TDA and Webull are good brokers as they fill your orders quickly. If you’re using Robinhood to day trade, our recommendation is to transition over to TDA or Webull.

To execute a stock options trade, you will need to have an account with a reputable broker that offers options trading which typically you’ll also have to get approved for stock options trading. Many brokers provide user-friendly platforms that make executing trades simple and quick.

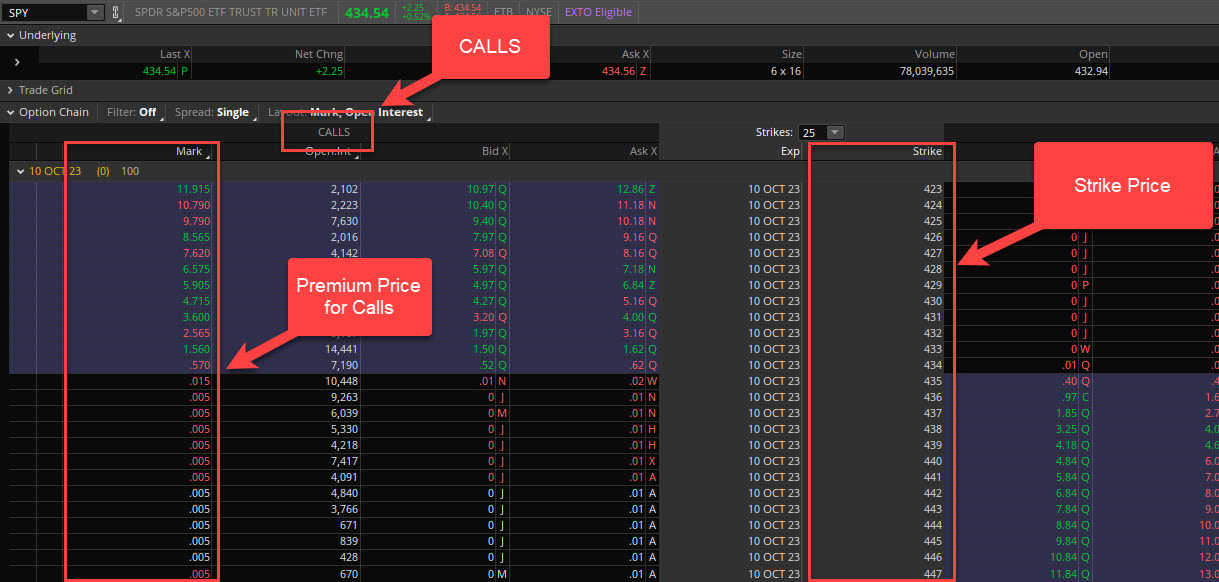

See the example below of the $SPY ticker and Expiration Date:

When placing an order for an options trade, you will need to specify whether you are buying or selling the contract. If you are buying, you can choose between a market order or a limit order. A market order will be executed at the current market price, while a limit order allows you to set a specific price at which you are willing to buy.

When placing an order for an options trade, you will need to specify whether you are buying or selling the contract. If you are buying, you can choose between a market order or a limit order. A market order will be executed at the current market price, while a limit order allows you to set a specific price at which you are willing to buy.

If selling an option contract, there are different types of orders available such as limit orders or stop orders. These allow you to set parameters for when and at what price your sell order should be executed.

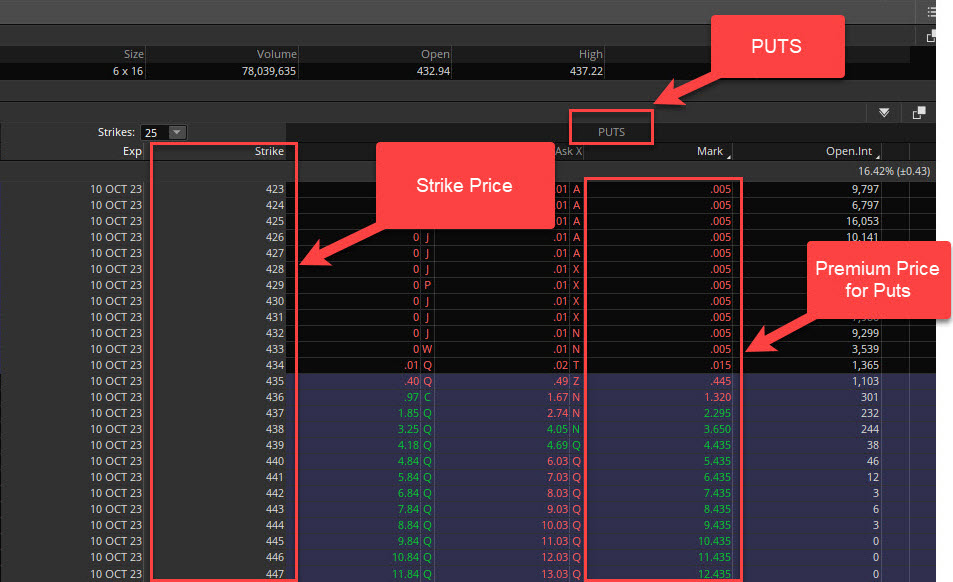

It’s important to double-check all details of your trade before confirming it. Ensure that everything is correct including the strike price, expiration date, and quantity of contracts being traded.

Here is an example of the full options chain for Calls:

Here is an example of the full options chain for Puts:

Once your trade is executed successfully on the platform provided by your broker, remember to keep track of its progress and make adjustments if necessary based on how the underlying stock moves.

Executing stock options trades requires precision and attention to detail. With practice and experience, this process will become second nature as part of your overall day trading strategy.

Managing Risk

When it comes to day trading options, managing risk is crucial for long-term success. Here are some tips to help you navigate the potential risks involved:

Start with a solid plan

Before you enter any trade, have a clear plan in place. Define your entry and exit points, set profit targets, and determine your maximum loss tolerance.

Use stop-loss orders

A stop-loss order is an essential tool that helps protect against significant losses. By setting a predetermined price level at which your position will be automatically closed out, you can limit potential damage from adverse market movements.

Diversify your trades

It’s important not to put all of your eggs in one basket when it comes to options day trading. Diversifying your trades across different stocks or sectors can help reduce the impact of any single loss.

Keep emotions in check

Emotions can cloud judgment and lead to impulsive decisions. Stick to your strategy and avoid making emotional trades based on fear or greed.

Practice proper position sizing

Determine how much capital you’re willing to risk on each trade and adjust your position size accordingly. This ensures that no single trade has the potential to wipe out a significant portion of your account.

Establish realistic expectations

Day trading options can be highly volatile, so it’s important not to expect overnight success or massive profits every time. Set realistic goals and focus on consistent profitability over time.

Remember, managing risk should always be a priority when engaging in day trading options. By implementing these strategies and staying disciplined, you’ll be better equipped for long-term success in this exciting but challenging endeavor!

Trading the Market Open: Our Strategy

Here is an inside look at one of our trading strategies at market open.

When Are We trading?

Market Open.

Why trade the market open? Simple answer: the volatility in the first hour. Everyone in the morning in honed in at bell open to start trading in the morning.

What Are We trading?

We trade the monster players ETFs : $SPY, $QQQ, $SPX

ProTip: New traders, here is some advice. Stick to 1 of these markets and only 1. If you’re looking to day trade, these 3 are the ones with the most volatility where you can catch solid moves. I would even stay away from $SPX as you can use $SPY due the clearer volume profile.

Once you start getting a hang of things you can move over to the other types of stocks to start day trading those.

These 3 are our go-to’s! Check out the following example below on $SPY 5 minute chart:

Step 1: Find Your Levels

This is key. You must find your levels to reference when to get in. This will allow you to follow a plan you set for yourself. This will let you know what Strike Prices you want to take a position in.

In our $SPY example, our levels are 433.50 for Calls and 432 for Puts.

Step 2: Choose your Expiration Date

For the more seasoned vets, they’ll go with the 0dte or 1dte as this offers better returns but also comes with higher risk.

For the beginners, weekly or 2 week expiration date.

In our example, we took a same day 0dte strike as it was early in the morning. The typical rule is if it’s after 12 PM EST, you can start thinking about 1dte plays.

Step 3: Choose your Strike Price and Strategy

Make this simple, the further OTM (out-the-money) the risker they are but they can provide bigger returns.

Typically, we take 1 or 2 strike OTM, in this example, since we were trading in the mid $433 price range, we took a $435 strike price.

As we are looking to take this trade to the upside, we took a Call strategy.

Step 4: Follow Your Trading Rules

This will differ among traders as everyone has a different risk management. When we say to follow your trading rooms is that if or when hits your take profit or stop loss, exit the trade. You must follow the plan you set and try to avoid emotional decisions.

In our example, used a typical trailing stop loss which ended up hitting after about an hour into the trade as you can see the trade rallied the first hour and a half. These are the types of signals which are called out in our stock options trading room service. Entry and exit signals are provided which are a great plays for our members as we provide consistency.

Day Trading Overview

So there you have it – the basics, tips, strategies, and example of day trading options! Whether you’re new to options or looking for ways to improve your current strategy, understanding the fundamentals is essential for achieving consistent profitability. We provide options trading trading room services such as Platinum and 5K Challenge which allows you to take advantage of our premarket analysis as well as our intraday market analysis.

In conclusion, day trading options can be a highly lucrative endeavor for those willing to put in the time and learn the strategies. The potential for quick gains and the ability to profit from both rising and falling markets make it an attractive choice for new and seasoned traders.

However, it’s crucial to remember that with great potential rewards there is always risks, and thorough technical analysis and risk management are essential to start seeing consistency in trading.