Overview of Flowalgo

This is Jimmy from stockkingoptions.com and today I’m going to show you a FlowAlgo and the stock options strategy which we use on a daily basis.

So today we’re going to discuss stock options strategies using flowalgo.com.

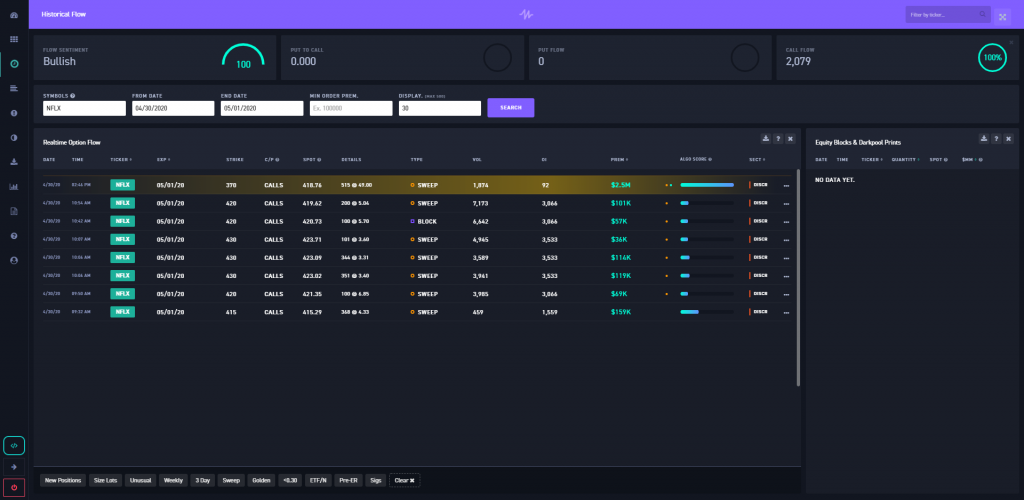

To give a quick overview, these are the option order flows that come in line by line as they are being placed. Our example will be from May 6, 2020, and these are today’s order flows.

The orders come in with a specific order and they are posted with their symbol, time expiration date, strike price, call or put, and the time which the stock price was when the option was bought.

Contracts and contract prices are also shown.

Additionally, we can see if the stock option contract was submitted as a split, sweep, or block.

I will actually describe those are in another post of the meaning behind the stock options contact for sweep, split, or block types of trades.

Currently, the Algo score, which is in beta, is also shown on the bottom left-hand side of the dashboard. This is meant to be seen as a quick view.

The dark pool section which shows the orders trying to take place outside of the market.

FlowAlgo: Alpha AI (beta)

In the Alpha AI, we use it all the time as an idea of something that gives us an idea from the dark pool of what stocks to look at and want to get in.

Today, specifically, were going to look at one of our options strategies which came in on May 30.

Stock Options Example

So on 4/30/2020, we’re gonna bring up a Netflix from 4/30/2020 and I want to bring just everything that came in on Thursday to May 1 is a Friday. See the screenshot below:

There were eight orders for Netflix call orders, if it’s a green it’s a call, and if it’s red it’s a put.

For Netflix call orders which came in on March 30, these were set to expire the next day.

These stock option orders had strike prices between 370 and 420.

All times are Eastern Standard time.

At 2:44 PM EST, there was a stock options order for the price of 375 contracts at 2:34 pm and it cost them $2.5 million.

How we interpret this data is we take this is basically copying the same order to a smaller volume which you can afford as a trader and follow the Smart Money.

These trades are not placed as a gamble. They have information which we are not privy to so they go and place the order and we follow the same orders.

The key in this example is that the option order is expiring the next day. The big money placed isn’t placed on just a hunch.

Once they placed this option order as you can see, the next day on May 1st, 2020, they hit the strike price on this option straight here they made more money going as the stock rose, so the money here so they hit 100% return on this trade.

Throughout the day, they were more orders coming in in the morning.

The last one for the day came in at 2:44 PM.

You know what I know what I’m trying to get you to grasp is not the amount of money, but the number of orders that came in.

That’s what we call “order flow”.

All these orders for the next day expiration and this big money is not being invested as just a gamble and possibly toss this all this money away.

Guess what happened the next day. Netflix skyrocketed! Investors probably took profit once they hit their Strike Price. That power of using FlowAlgo!

For the day prior, you basically follow the smart money, so you’re kind of joining the trade that they’re investing in.

The next day it skyrockets and touches all strike prices which were placed with the big money.

If you were in this trade, as we called out in our Platinum Trading Room, you were able to profit at 100%, maybe 200%+ return at its peak depending on the price.

So that is the power of flow Algo! This is happening not only with Netflix but with multiple trades on a daily basis. Just analyzing how these orders came out and when these orders came in, basically following the smart money trying to take advantage of the order flow.

For that NFLX trade, we were in for 2K. We ended up profiting 3.5K, so in total the option was worth 5.5K once we cashed out and called out in our trading rooms.

The best part about this is that you don’t have to do all the work. We do this for you. By joining one of our trading rooms, we give you entry and exit signals to trades like this.

We have two dedicated traders who are calling out trading on a daily basis. Check out our Instagram. DM us on there if you have any questions. We’ll be happy to answer them as best as we can.

We take you through our example in this video. Click and watch!